Ways to qualify for the EB-5 Investment Amount and secure your U.S. Visa

Optimize Your Financial Investment: An Extensive Check Out the EB-5 Visa Opportunity

The EB-5 Visa program presents a compelling opportunity for international investors looking for permanent residency in the USA via strategic monetary dedications. With differing investment thresholds and the capacity for considerable financial influence, this program not only helps with migration but likewise lines up with more comprehensive goals of task production and community growth. Nevertheless, navigating through the complexities of the application procedure and comprehending the linked risks are vital for making the most of the benefits of this chance. As we explore these elements, essential insights will arise that might greatly influence your financial investment technique.

Review of the EB-5 Visa

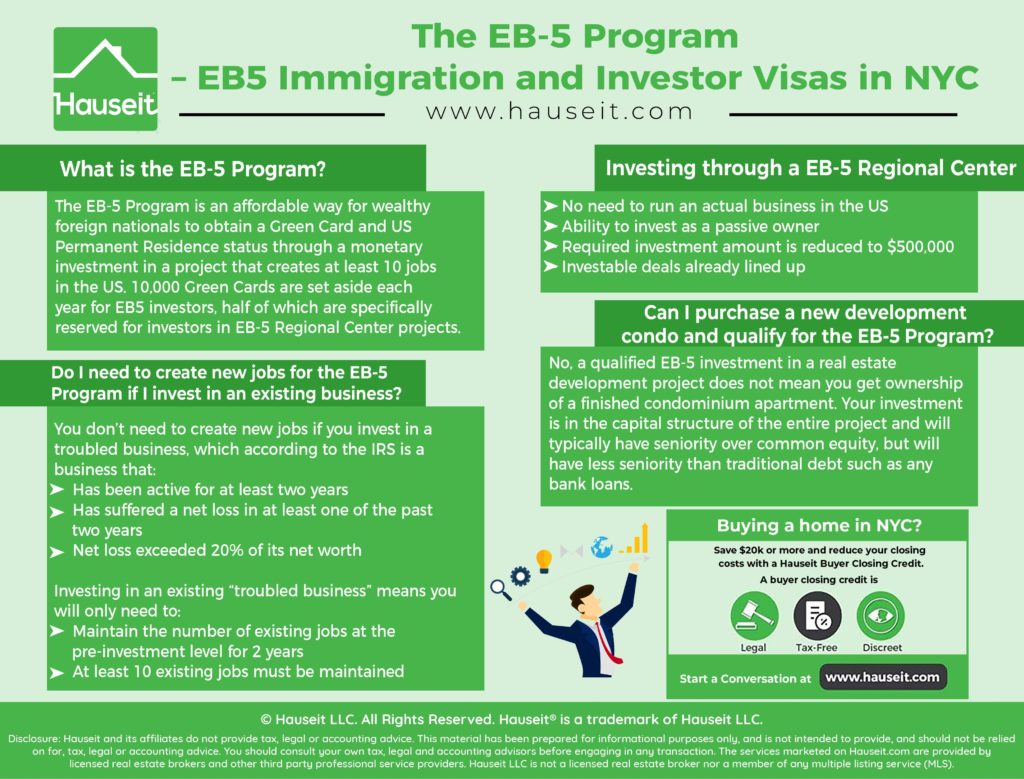

The EB-5 visa program provides an one-of-a-kind pathway for foreign capitalists seeking long-term residency in the United States, permitting them to get a visa by purchasing U.S. companies. Established by the Migration Act of 1990, the program intends to promote the U.S. economy via capital expense and task development. It is developed for individuals that can meet specific standards, consisting of the investment of a minimum required quantity in a new business.

The EB-5 program is remarkable for its focus on job production; financiers should show that their financial investment will preserve or develop a minimum of 10 full-time work for U.S. workers. This concentrate on economic advantage straightens with the program's goal of drawing in international funding to enhance regional economies. In addition, the EB-5 visa allows investors and their prompt member of the family to reside in the united state while appreciating the benefits of irreversible residency.

Investment Needs and Options

Financiers interested in the EB-5 visa program have to comply with details investment needs that dictate the minimum resources necessary for qualification. As of 2023, the conventional financial investment quantity is $1 million. Nevertheless, if the financial investment is routed towards a Targeted Work Location (TEA)-- defined as a backwoods or one with high unemployment-- the minimum demand is reduced to $800,000.

The EB-5 program provides two key opportunities for investment: Direct Financial investment and Regional Center Financial Investment. Direct financial investment includes the investor developing or investing in a brand-new company that creates a minimum of ten permanent jobs for certifying U.S. employees. This path may need much more energetic involvement in business procedures.

On The Other Hand, Regional Facility investment permits investors to add to pre-approved projects handled by marked Regional Centers. This choice often provides a much more passive financial investment possibility, as the Regional Center handles the obligation of job development and conformity with EB-5 regulations.

Advantages of the EB-5 Program

Taking part in the EB-5 program opens up a path to various advantages for foreign capitalists seeking united state residency. Among the main benefits is the possibility for investors and their immediate family members to acquire an U.S. visa, granting them permanent residency. This status permits people to live, work, and study anywhere in the United States, giving access to a wide range of resources and chances.

Participants in the EB-5 program advantage from the stability and protection connected with U.S. residency, consisting of the protection of possessions and the capability to take a trip openly in and out of the country. In general, the EB-5 program provides a distinct opportunity for international financiers to get residency while adding to the united state economic climate, making it an attractive alternative for those seeking brand-new beginnings.

Job Production and Economic Impact

The EB-5 visa program plays an essential function in boosting job development and fostering economic growth in the USA. By attracting foreign financial investment, it not only produces brand-new employment possibility but additionally improves neighborhood economic climates. Understanding the program's effect on work markets and economic advancement is essential for prospective capitalists and communities alike.

Job Development Prospective

Harnessing the capacity of the EB-5 visa program can significantly add to job creation and financial development within targeted areas. The program mandates that each foreign financier add a minimum of $900,000 in a targeted employment area (TEA) or $1. EB-5.8 million in other regions, with the goal of producing or preserving at the very least 10 permanent work for united state employees. This requirement not just incentivizes international financial investment yet additionally boosts neighborhood economies by generating employment chances

Projects funded with the EB-5 program commonly concentrate on markets that are essential for development, such as property hospitality, infrastructure, and advancement. These campaigns can lead to the facility of brand-new services, expansion of existing firms, and inevitably, a stronger workforce. Additionally, the influx of funding from EB-5 capitalists enables for the endeavor of large-scale tasks that would or else be impossible, therefore enhancing work development potential.

Along with route work, the causal sequence of task creation expands to supplementary services and industries, promoting a robust financial environment. The EB-5 visa program, subsequently, plays a critical duty in driving task development and sustaining neighborhood areas, making it a critical financial investment chance.

Financial Growth Payments

EB-5 investors' payments to financial growth prolong past plain job development, encompassing a vast array of positive effects on regional and regional economic climates. By investing a minimum of $900,000 in targeted employment locations or $1.8 million in non-targeted areas, these capitalists facilitate the establishment and growth of businesses, which rejuvenate area infrastructures and services.

The funding influx from EB-5 investments usually leads to the development of new industrial jobs, genuine estate endeavors, and vital services. This not only creates direct employment opportunities however likewise promotes indirect task growth within supporting industries, such as retail, building, and hospitality. EB-5. Raised service activity enhances tax revenues, offering neighborhood governments with additional sources to money public solutions and facilities renovations.

The wider economic impact of the EB-5 program consists of boosted consumer costs, enhanced property values, and boosted area features. Therefore, areas that bring in EB-5 investments usually experience a revitalization of regional economies, cultivating a setting helpful to sustainable growth. Inevitably, the EB-5 visa program functions as an effective tool for economic advancement, benefiting both capitalists and the areas in which they spend.

The Application Refine Explained

The application process for the EB-5 visa includes several critical actions that prospective financiers should navigate to protect their visa. Comprehending the eligibility needs is important, as this structure will lead applicants with each phase of the process. In the following sections, we will certainly detail these needs and provide a comprehensive step-by-step overview to successfully finishing the application.

Qualification Requirements Overview

Navigating with the eligibility requirements for the EB-5 visa can be an intricate procedure, however recognizing the essential elements is necessary for prospective investors. The EB-5 visa program is designed for foreign nationals looking for permanent residency in the United States via financial investment in a new business. To qualify, a candidate must spend a minimum of $1 million, or $500,000 in targeted work areas (TEAs), which are specified as high-unemployment or country regions.

Furthermore, the financier has to demonstrate that the investment will create or protect at the very least 10 full-time jobs for certifying U.S. employees within 2 years. It is also crucial for the candidate to prove that the funds used for investment are lawfully obtained, necessitating comprehensive documentation of the source of resources.

In addition, the capitalist has to be proactively associated with the service, although this does not need everyday management. Conformity with these eligibility needs is crucial, as failing to satisfy any kind of standards can lead to the rejection of the visa. Recognizing these parts not just help in preparing a durable application yet likewise improves the chance of efficiently steering the EB-5 visa process.

Step-by-Step Refine

Guiding through the application process for an EB-5 visa requires an organized method to ensure all demands are fulfilled successfully. The very first step entails picking an ideal financial investment task, preferably within a marked Targeted Work Area (TEA) to optimize advantages. After recognizing a job, it is necessary to carry out comprehensive due diligence to examine its viability and compliance with EB-5 policies.

Next off, applicants have to prepare Kind I-526, Immigrant Petition by Alien Financier, outlining the investment's resource of funds and financial impact - EB-5 Visa by Investment. This type is gone along with by supporting paperwork, including proof of the investment and evidence of the project's work development potential

Upon approval of Form I-526, applicants can proceed to request an immigrant visa via consular processing or adjust status if already in the U.S. This entails submitting Kind DS-260, Application for an Immigrant Visa and Alien Enrollment.

Common Challenges and Factors To Consider

Maneuvering the EB-5 visa procedure provides numerous typical difficulties and factors to consider that potential investors need to very carefully review. One main worry is the substantial monetary investment required, which presently stands at $1.05 million or $800,000 in targeted employment locations. This significant funding commitment requires extensive due persistance to ensure the job is sensible and straightens with the financier's financial goals.

An additional obstacle is the lengthy processing times related to EB-5 applications, which can extend beyond 2 years. Financiers should be planned for possible hold-ups that might influence their immigration timelines. In addition, the demand to preserve or develop a minimum of ten full time tasks can make complex project option, as not all ventures ensure work development.

Moreover, the risk of financial investment loss is an essential factor to consider. Investors should look for jobs with a solid record and clear administration to alleviate this risk. Lastly, modifications in immigration policies and guidelines can affect the EB-5 program's stability, making it necessary for capitalists to stay informed about legal advancements. A complete understanding of these obstacles will certainly enable potential capitalists to make enlightened choices throughout the EB-5 visa process.

Success Stories and Situation Studies

The EB-5 visa program has made it possible for countless investors to attain their immigration goals while adding to the U.S. economic climate with task creation and capital expense. A noteworthy success tale is that of a Chinese entrepreneur that purchased a local center focused on renewable resource. His financial investment not just safeguarded his family members's visas yet also helped with the production of over 200 tasks in a battling neighborhood, highlighting the program's double benefits.

Another compelling case involves a team of investors who merged sources to create a deluxe resort in a city. This task not just created significant job opportunity however additionally renewed the neighborhood tourism industry. The capitalists successfully obtained their visas and have given that expanded their organization profile in the U.S., more demonstrating the possibility for development through the EB-5 program.

These instances highlight just how tactical investments can bring about individual success and wider economic impact. As possible financiers think you could try these out about the EB-5 visa, these success stories function as a confirmation of the program's possibility to change lives and communities alike, encouraging more participation in this important opportunity.

Frequently Asked Questions

What Is the Normal Handling Time for an EB-5 Visa?

The normal handling time for an EB-5 visa differs, frequently ranging from 12 to 24 months. Elements influencing this timeline consist of application volume, individual scenarios, and regional center authorizations, affecting overall handling effectiveness.

Can My Household Join Me on the EB-5 Visa?

Yes, your family members can join you on the EB-5 visa. Spouses and single youngsters under 21 are qualified for derivative visas, allowing them to obtain permanent residency together with the primary candidate in the EB-5 program.

Exist Certain Industries Preferred for EB-5 Investments?

Yes, particular industries such as realty, friendliness, and framework are typically liked for EB-5 investments. These sectors normally show strong development possibility, work creation capability, and placement with united state financial advancement goals.

What Occurs if My Financial Investment Fails?

If your financial investment falls short, it may endanger your eligibility for the EB-5 visa. The U.S. Citizenship and Immigration Solutions needs proof of job development and funding at risk; failure to satisfy these might result in application rejection.

Can I Live Throughout the U.S. With an EB-5 Visa?

Yes, owners of an EB-5 visa can stay anywhere in the United States. This flexibility enables investors and their families to pick their favored locations based upon personal demands, employment possibility, and way of living choices.

The EB-5 visa program uses an one-of-a-kind path for foreign financiers looking for permanent residency in the United States, enabling them to acquire a visa by investing in United state businesses. Financiers interested in the EB-5 visa program have to adhere to specific financial investment requirements that dictate the minimal funding needed for qualification. The EB-5 program supplies two main avenues for investment: Direct Investment and Regional Center Financial Investment. Understanding these investment demands and alternatives is vital for prospective capitalists intending to navigate the intricacies of the EB-5 visa program efficiently. The EB-5 visa program has actually allowed countless investors to achieve their immigration objectives while contributing to the United state economic situation through task production and resources investment.